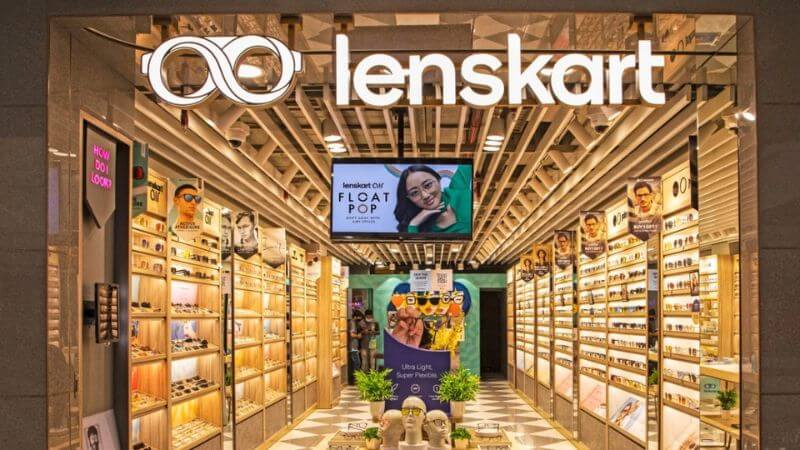

Lenskart is finally going for an IPO. Its retail eyewear business in India has confirmed that it plans to open its long-awaited IPO on October 31, 2025. It is a milestone for the company and investors who have been waiting to invest in the company that has transformed the way Indians purchase glasses.

- Price Band And Issue Size

- Real Performance Of Lenskart

- Store Network And Customer Base

- The Indian Eyewear Market – Huge Opportunity

- What Does Lenskart Make Money On?

- Who’s Selling Their Shares?

- What Are They Going To Do With The Fresh Issue?

- Latest Funding And Valuation History

- Market Trends Favorable

- Conclusion

The subscription period is three days — November 1 to November 4, 2025. The first choice is provided to the anchor investors on October 30, a day before the opening of the market to other investors.

In case you apply and receive shares, the allotment will be made by November 6. The stock will begin trading on BSE and NSE on November 10, 2025.

Price Band And Issue Size

The company has set the price band between ₹382-₹402 per share. The gross issue size is ₹7,024 crore, which comprises ₹2,150 crore fresh capital for the company and ₹4,875 crore offer-for-sale by existing shareholders. At the higher price range, Lenskart is worth around ₹70,000 crore (around $8 billion). It is a big valuation for a retail company, but we will find out whether the figures justify it.

Real Performance Of Lenskart

Now, we are going to skip the marketing hype and have a look at some actual figures.

In FY2025, Lenskart earned ₹6,652.5 crore. This is 22.5 percent higher than the ₹5,427.7 crore they had achieved in FY2024. Good growth, consistent too.

However, here’s the point that counts the most — they are profitable at this point. Net profit was ₹297.3 crore in FY2025. Last year, they lost ₹10 crore. So they have made the turn from losses to profits.

Their EBITDA (earnings before interest, taxes, depreciation, and amortization) in FY2025 increased by 44.5% to ₹971 crore as compared to FY2024 (₹672 crore). Good business performance.

Revenue Over The Years

- FY2025: ₹6,652.5 crore

- FY2024: ₹5,427.7 crore

- FY2023: ₹3,788 crore

- FY2022: ₹1,502 crore

That is some strong, steady growth each year, not just one-time jumps.

Store Network And Customer Base

Lenskart has more than 2,500 stores across the world. Around 2,000 of these are in India. They have an estimated 5 million customers.

Since March 2019, the number of employees has grown to 3,250 compared to only 604 in March 2019. That is approximately a 35 percent per annum increase in headcount.

The Indian Eyewear Market – Huge Opportunity

This is where things become quite interesting. The eyewear market of India is worth $6,600 million in 2024. It will grow to $11,930 million by 2033. That is almost two times growth in less than 10 years, with an annual increase of 11.93%.

However, the best part is that the market is grossly underpenetrated. Approximately a third of the Indian population requires glasses, and only a quarter of them wear them. The corrective eyewear penetration rate has been 7 percent overall.

Compared with developed countries, where penetration rates are significantly greater, there’s a huge gap to fill.

By 2030, vision correction will be required for almost one billion Indians. However, fewer than 40% will wear prescription glasses. That is hundreds of millions of potential customers.

What Does Lenskart Make Money On?

Approximately 58% (₹3,154 crore) of the revenue in FY2024 was brought in from India. The other 42% (₹2,273 crore) came from international markets such as Japan, Singapore, Taiwan, and Thailand.

This is smart geographic diversification. It eliminates reliance on one market and offers a variety of growth amplifiers.

Market Position: The Leader

Lenskart controls the organized eyewear market in India with a market share of up to 90 percent. It has a customer base of over 30 million every year. They experience a growth rate of 15-18 percent, which is much higher than the overall market growth of 9-11 percent per year.

Its primary rival is Titan Eye Plus, which has 860+ stores in 384 cities with revenue of ₹689 crore in FY2023. Whereas Titan is a formidable competitor with the support of the Tata Group, Lenskart is significantly bigger.

Who’s Selling Their Shares?

This IPO has two components:

- Fresh Issue (₹2,150 crore): This is the money directly going to the business to expand it.

- Offer for Sale (₹4,875 crore): Current shareholders are selling part of their stakes.

Some of the selling shareholders include the founders and promoters Peyush Bansal, Neha Bansal, Amit Chaudhary, and Sumeet Kapahi. They are not exiting completely but are diluting their interests.

Some key investors selling include:

- SoftBank (19.84% currently)

- TR Capital

- Chiratae

- Kedaara Capital

- PI Opportunities Fund

- MacRitchie Investments

- Alpha Wave

Schroders Capital Private Equity Asia Mauritius is fully exiting, selling all 1.9 crore shares (1.13% stake) in the company.

What Are They Going To Do With The Fresh Issue?

The fresh issue of ₹2,150 crore will be utilized for:

- Investment in cloud infrastructure and technology

- Brand promotion and marketing

- Potential acquisitions to grow the business

- General corporate purposes and working capital

Latest Funding And Valuation History

In June 2024, Lenskart raised a secondary investment round of $200 million, led by Temasek and Fidelity Management & Research Company (FMR).

Their most recent financing was the Series G in December 2019, in which they collected ₹1,652 crore. In 2019 itself, the company had already become a unicorn (valuation of over $1 billion).

By the end of 2024, the company’s valuation had reached $6.1 billion.

Strategic Acquisitions

In 2022, Lenskart bought a Japanese eyewear company for about $400 million. This purchase enabled Lenskart to expand globally into Japan and Southeast Asia.

More recently, they acquired GeoIQ, a location intelligence startup, owning a 17.11% stake.

In July 2025, Lenskart invested in AjnaLens, a Mumbai-based startup working on extended reality (XR) and artificial intelligence (AI) smart glasses.

Market Trends Favorable

Increased Screen Time: India has a population of over 840 million internet users, and out of these, over 400 million people are active smartphone users. Increased screen hours are driving the demand for eyewear and blue-light-blocking glasses due to eye strain and vision issues.

E-commerce Growth: The e-commerce market in India is growing at a rate of 29.3% annually between 2024 and 2032. Online eyewear retailing is becoming mainstream, and Lenskart was the pioneer in this market in India.

Luxury Segment: The luxury eyewear market is estimated to grow at 11.72% annually, with a value of $891 million in 2024 and $1,721 million in 2030. Rising incomes are driving this demand for high-end eyewear.

Conclusion

The IPO of Lenskart has great potential in the Indian retail market. The company has a solid financial performance with steady revenue growth and profitability in FY2025.

The penetration rate of the Indian eyewear market is minimal; thus, it has enormous growth prospects. Lenskart is well-positioned to capture this opportunity because it already enjoys 90% market share in the organized segment and has a robust omnichannel model.

However, with a valuation of ₹70,000 crore, investors must critically assess whether the price is justified. The firm will still face competition from Titan Eye Plus and other new entrants.

Follow Us: Facebook | X | Instagram | YouTube | Pinterest